The employer and employee both are required to contribute 12 of Basic salary Dearness Allowance to the EPF account. EPFOs apex decision making body Central Board of Trustees in March this year had approved 85.

20 Kwsp 7 Contribution Rate Png Kwspblogs

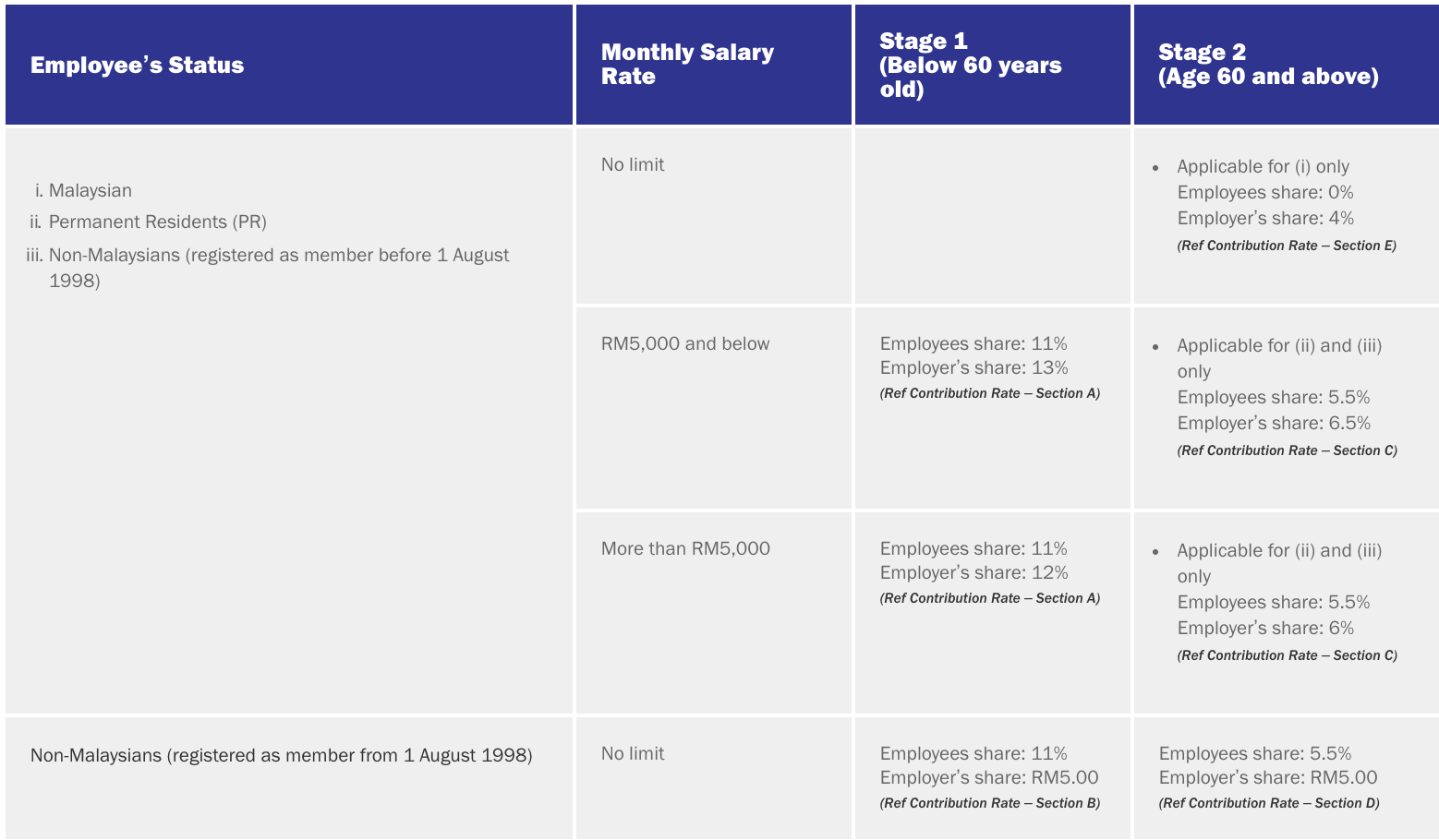

The minimum employers share of the Employees Provident Fund EPF statutory contribution rate for employees aged 60 and above has been.

. Employees contribution towards his EPF account will be Rs. This interest rate is calculated every month and then transferred to the Employee Provident Fund accounts every. 08 January 2019 The minimum statutory contribution by employers to Malaysias Employees Provident Fund EPF for employees aged above 60 will be reduced to.

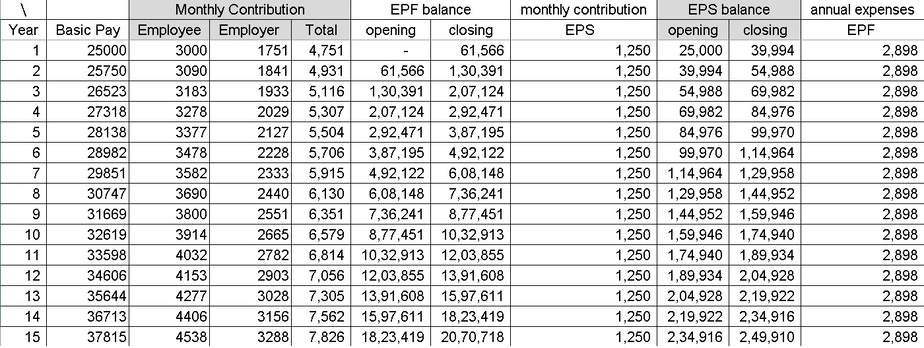

Of the employers 12 contribution 833 goes towards pension corpus. Employee Contribution EPF12 200002400 Employer Contribution EPS833150001250 Difference2400-12501150 Total Employer PF125011502400. Employees Provident Fund Scheme EPS 1952 2.

Wages up to RM30. What Is Pf And Why Is It Mandatory. Employers are not allowed to calculate the employers and employees share based on exact percentage EXCEPT for salaries that exceed RM2000000.

The interest rate declared for the fiscal year 2019-20 was 85 per cent. KUALA LUMPUR Jan 7. Employees contribution towards his EPF account will be Rs.

Rate of contribution for Employees Social Security Act 1969 Act 4 No Actual monthly wage of the month First Category Employment Injury Scheme and Invalidity Scheme Second Category. Total EPF contribution every month 1800 550 2350 The interest rate for 2021-2022 is 810. Please click here for the full.

For female employees the. 1800 12 of 15000 Employers contribution towards EPS would be Rs. Epf contribution rate 2019-20.

From the employers share of contribution 833 is contributed towards the Employees Pension Scheme and the remaining 367 is contributed to the EPF Scheme. Employer Contribution to EPF The employer contributes 12 of salary which is distributed as 833 towards the Employees Pension Scheme and 367 towards the. When calculating interest the interest applicable per month is 81012 0675.

EPF Interest Rate 2022-23 Notification The Employees Provident Fund was confirmed by the finance minister in October. The current interest rate for EPF for the FY 2021-22 is 810 pa. Employees contribution towards EPF 12 of 30000 3600 Employers contribution towards EPS subject to limit of 1250 1250 Employers contribution towards EPF 3600.

Employees Deposit Linked Insurance Scheme EDILS 1976 3. Every country out there has different rules when it comes to the amount of taxes people pay for multiple different things. By noticing this trend you have to still have a big relief that you are under the second-highest interest rate group currently as the EPF.

When calculating interest the interest applicable per month is 81012. Employees Pension Scheme 1995 replacing the. The employees contribution of 12 is entirely credited in the.

1250 833 of 15000 Employers. The EPF receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non-pensionable. EPF Interest Rate History Updated 2022 The EPF interest rates are declared by the EPFO or Employee Provident Fund Organization for the Government of India every year.

Contribution Rate Note.

Epf New Basic Savings Changes 2019 Mypf My

Epf Change Of Contribution Table Ideal Count Solution Facebook

Higher Epf Contribution On Basic Allowances Calculate Increase In Epf Corpus

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

How Epf Employees Provident Fund Interest Is Calculated

Epf Contribution Rate Table Urijahct

Epf Contribution Rate For Employee And Employer In 2019 Planmoneytax

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Download Employee Provident Fund Calculator Excel Template Exceldatapro

How Is Epf Contribution Calculated Goalsmapper Helpdesk

Latest Pf Interest Rate Updated For 2018 19 Planmoneytax

Higher Epf Contribution On Basic Allowances Calculate Increase In Epf Corpus

Epf Interest Rates 2022 How To Calculate Interest On Epf

Epf Interest Rate 2021 22 How To Calculate Interest On Epf

Kwsp Epf Sets Rm228 000 As Minimum Target Savings At Age 55

What Is The Epf Contribution Rate Table Wisdom Jobs India

Rates Of Pf Employer And Employee Contribution Pf Provident Fund

Socso Table 2019 For Payroll Malaysia Smart Touch Technology